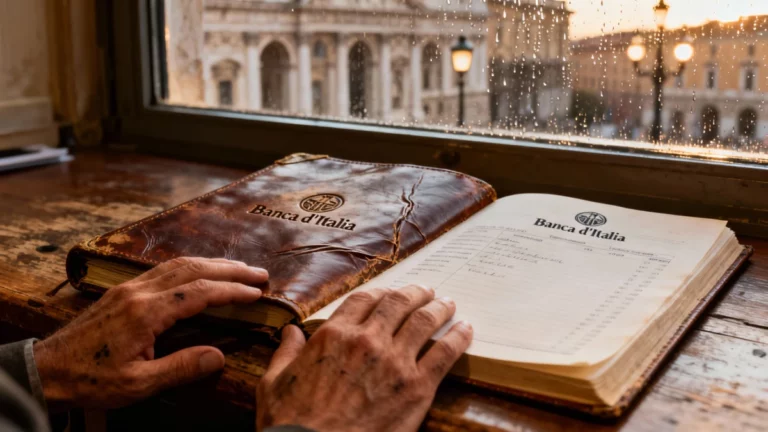

Banks and Insurers Called to Action

The Italian government, via Economy Minister Giancarlo Giorgetti, announced on Friday, October 17, that banks and insurance firms would need to contribute several billion euros to the nation’s accounts. This would be done through a series of targeted measures. Giorgetti explained,

“It’s a mixture of measures (…), I think they can be absorbed by the system without repercussions.”

The cocktail of provisions means that banks and insurers are expected to use some of their reserves, and companies will also see an increase in local corporate tax rates. According to Italian media, the total contribution should reach €4.5 billion in 2026.

Giorgetti pointed out that the banks’ agreement to this measure was, in his own words,

“accepted, albeit with reluctance.”

A Balancing Act Within the Coalition

The 2026 budget is designed to bring Italy back in line with European Union fiscal rules, with a public deficit target of 2.8% of GDP for the year—comfortably below the EU ceiling of 3%.

Yet, getting the banks on board was far from easy. This was the last big knot to untangle for the governing coalition, with positions ranging from the far-right League, which supported the contribution, to the more conservative Forza Italia, which resisted until the eleventh hour. Deputy Prime Minister and Forza Italia secretary Antonio Tajani even celebrated the fact that there would be

“no (direct) tax on banks’ windfall profits.”

“A Win-Win”? Banks Thanked, Even If Reluctantly

Prime Minister Giorgia Meloni expressed her gratitude to the banks, highlighting what she described as

“an awareness regarding the overall framework of Italy, built around a strategy that works and ultimately benefits them as well,”

thanks to the country’s financial stability.

What Else Is in the €18 Billion Budget?

It’s not all just about squeezing the banks. The €18 billion 2026 budget contains a host of other measures aimed at helping average Italians and strengthening the country’s safety net:

- Tax cuts of about €9 billion stretched over three years, targeted mainly at the middle class,

- A fiscal amnesty just for the 2023 tax year,

- Several smaller reassessments,

- Increases to the lowest pensions by €20 a month,

- The working mothers’ bonus will grow from €40 to €60 per month,

- An additional €5 billion earmarked in 2026 to shore up Italy’s struggling public healthcare system.

This extra funding is projected to enable the hiring of around 6,300 nurses and 1,000 doctors. Nurse salaries are also slated for a boost of some €1,630 in 2026.

One last thing? Before any of these plans officially hit the books, the Italian Parliament still needs to give its stamp of approval. As with all budgetary adventures, there’s sure to be more spirited debate before these measures become reality—but for now, Italy seems ready to lean on its banks in the hope of a brighter, more stable fiscal future.